In the last post, we extended the N-stock problem to the N-alpha problem in quadratic optimization portfolios.

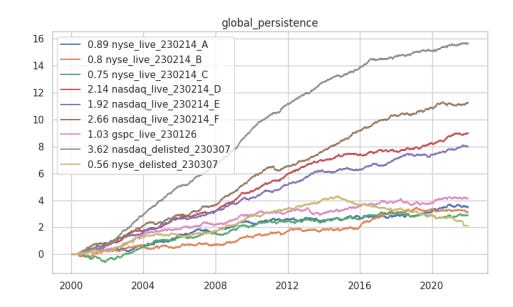

We release our formulaic alpha report here: (I think this is our best-performer published so far) :frictionless Sharpe figures labelled on log-wealth.

Effective soon (latest 10/04/23), we will be archiving posts older than one year. For those who want to keep records, please make sure to save your own copy. This is to preserve capacity for our own and long-time readers. We have a fair bit of institutional following, and would like to address these capacity concerns for our own well-being. Our blog is evolving progressively into a platform for quant finance and systematic trading professionals working on their fundamentals and inspiring ideas in their own career. We hope to balance this evolution of the collective directive with our personal one.

In our formulaic alpha report, we introduce a new function `kentau’. This refers to the kendall-tau correlation, a non-parametric variant of the pearson correlation. Readers should refer to literature. Python implementation can be found here:

https://docs.scipy.org/doc/scipy-0.15.1/reference/generated/scipy.stats.kendalltau.html

Formulaic Alpha Report: (paid readers)