For weeks, we have beeen talking about releasing the new version of the alpha reports that feature more datasets and primitives - it is finally here!

Preview

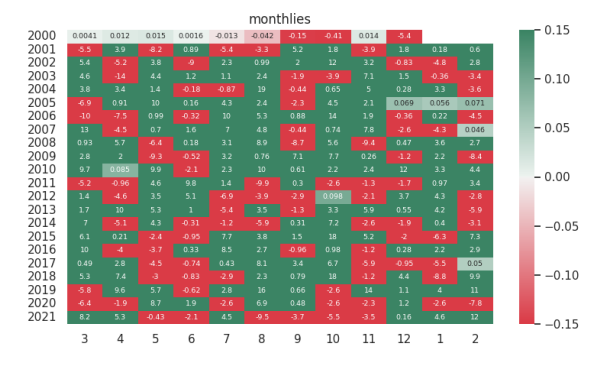

I am still tweaking some of the risk engines, and trying to obtain more quality datasets to present. As you can see, the new reports will be alot more succinct. We will only present the graphical and tabular results - we will create another paper on how to interpret these values, what they mean to the trader and how you should think about the figures in portfolio construction, which you can reference when needed. I think the previous reports were too lengthy with graphicals that were not very informative. I am looking to add more sections too to help the reader understand the strategy profile.

For example, now you can see how the alpha would have performed on an asset universe that consists of the delisted assets. If there are marked performance difference between the live datasets and delisted datasets, we would be cognisant of survivorship bias.

Anyway, in the next few posts, we will discuss factor modelling, and the mathematics of single & multi-factor hedging. We discuss Fama style factor models and BARRA style factor models. We will create a separate post where we code out these factor models. We will also continue our discussions on Stochastic Calculus.

Full Report (Paid Readers):

The variables in the formulaic alpha can be obtained by using the yfinance module to access the balance sheet statements of company filings.