Formulaic Alpha Trade Demo

Hi! I’m still on travel - and won’t return to my desk till next week, but I just wanted to give a short demo on how you can use the different components of quantpylib to run, say, a formulaic alpha on live.

As promised, it will be incredibly easy. We make some imports, set up our keys:

import os

import pytz

import asyncio

from decimal import Decimal

from dotenv import load_dotenv

load_dotenv()

from datetime import datetime

import quantpylib.standards.markets as markets

from quantpylib.standards import Period

from quantpylib.gateway.master import Gateway

from quantpylib.datapoller.master import DataPoller

from quantpylib.simulator.gene import GeneticAlpha

exc = "hyperliquid"

config_keys = {

exc: {

"alias" : exc,

"address" : os.getenv("HYP_DEMO"),

"hyp_key" : os.getenv("HYP_KEY"),

}

}

datapoller = DataPoller(config_keys=config_keys)

gateway = Gateway(config_keys=config_keys)

interval = Period.DAILY

if __name__ == "__main__":

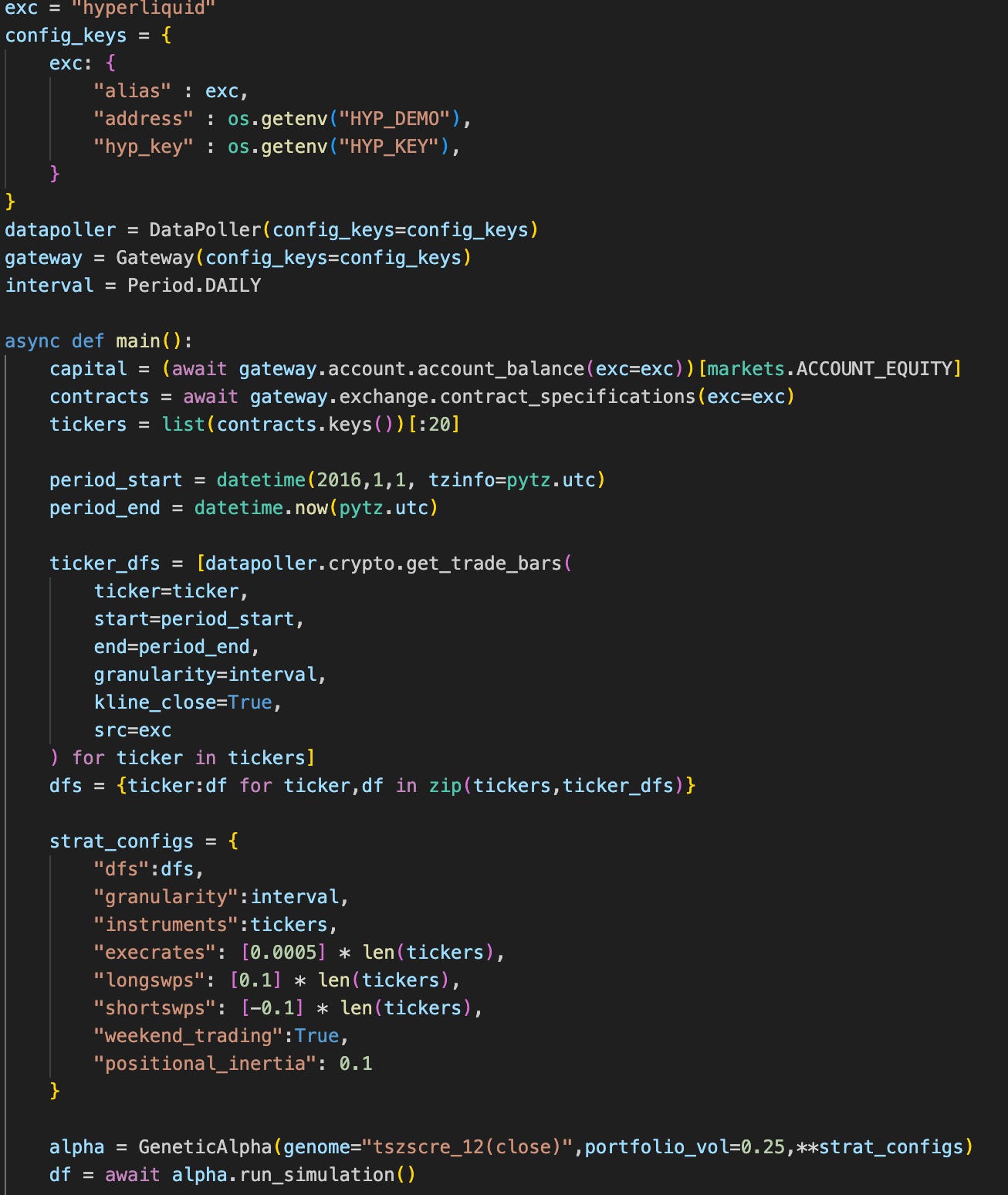

asyncio.run(main())Now let’s write the main method - we retrieve our capital, get the contracts available. and get OHLCV:

async def main():

capital = (await gateway.account.account_balance(exc=exc))[markets.ACCOUNT_EQUITY]

contracts = await gateway.exchange.contract_specifications(exc=exc)

tickers = list(contracts.keys())[:20]

period_start = datetime(2016,1,1, tzinfo=pytz.utc)

period_end = datetime.now(pytz.utc)

ticker_dfs = [datapoller.crypto.get_trade_bars(

ticker=ticker,

start=period_start,

end=period_end,

granularity=interval,

kline_close=True,

src=exc

) for ticker in tickers]

dfs = {ticker:df for ticker,df in zip(tickers,ticker_dfs)}

As usual, we set up our genetic alpha, write the fee parameters, inertia, volatility target and so on…then we run the backtest on say, the bollinger score momentum:

strat_configs = {

"dfs":dfs,

"granularity":interval,

"instruments":tickers,

"execrates": [0.0005] * len(tickers),

"longswps": [0.1] * len(tickers),

"shortswps": [-0.1] * len(tickers),

"weekend_trading":True,

"positional_inertia": 0.1

}

alpha = GeneticAlpha(genome="tszscre_12(close)",portfolio_vol=0.25,**strat_configs)

df = await alpha.run_simulation()Last but not least we obtain held positions from the gateway, and compute the contracts difference between target and held - then we use the gateway to submit orders:

held = await gateway.positions.positions_get(exc=exc)

take = alpha.get_positions_for_capital(capital=capital,held={k:v[markets.AMOUNT] for k,v in held.items()})

trade = {inst : Decimal(str(take[inst])) - (Decimal('0') if inst not in held else held[inst][markets.AMOUNT]) for inst in tickers}

trade = {inst : round(amount,int(contracts[inst][markets.SYMBOL_QUANTITY_PRECISION])) for inst,amount in trade.items()}

for inst,amount in trade.items():

res = await gateway.executor.market_order(exc=exc,ticker=inst,amount=amount)And just by changing the formulaic string - you can just about run about any trading strategy encoded formulaically….

Say you want to run this every day, on a new candle, we can schedule it on cron:

TZ=UTC

1 0 * * * python3 /path/alpha.pyThis runs it at 00:00:01 UTC every day. Get access to quantpylib here:

Will be back next week to superboost quantpylib again…so get ready!

Absolutely love this!