QT203 official release + important notes/announcements for Hangukquant.

Development of Robust Python Packages for Quantitative Trading (official release) https://hangukquant.thinkific.com/courses/qt203

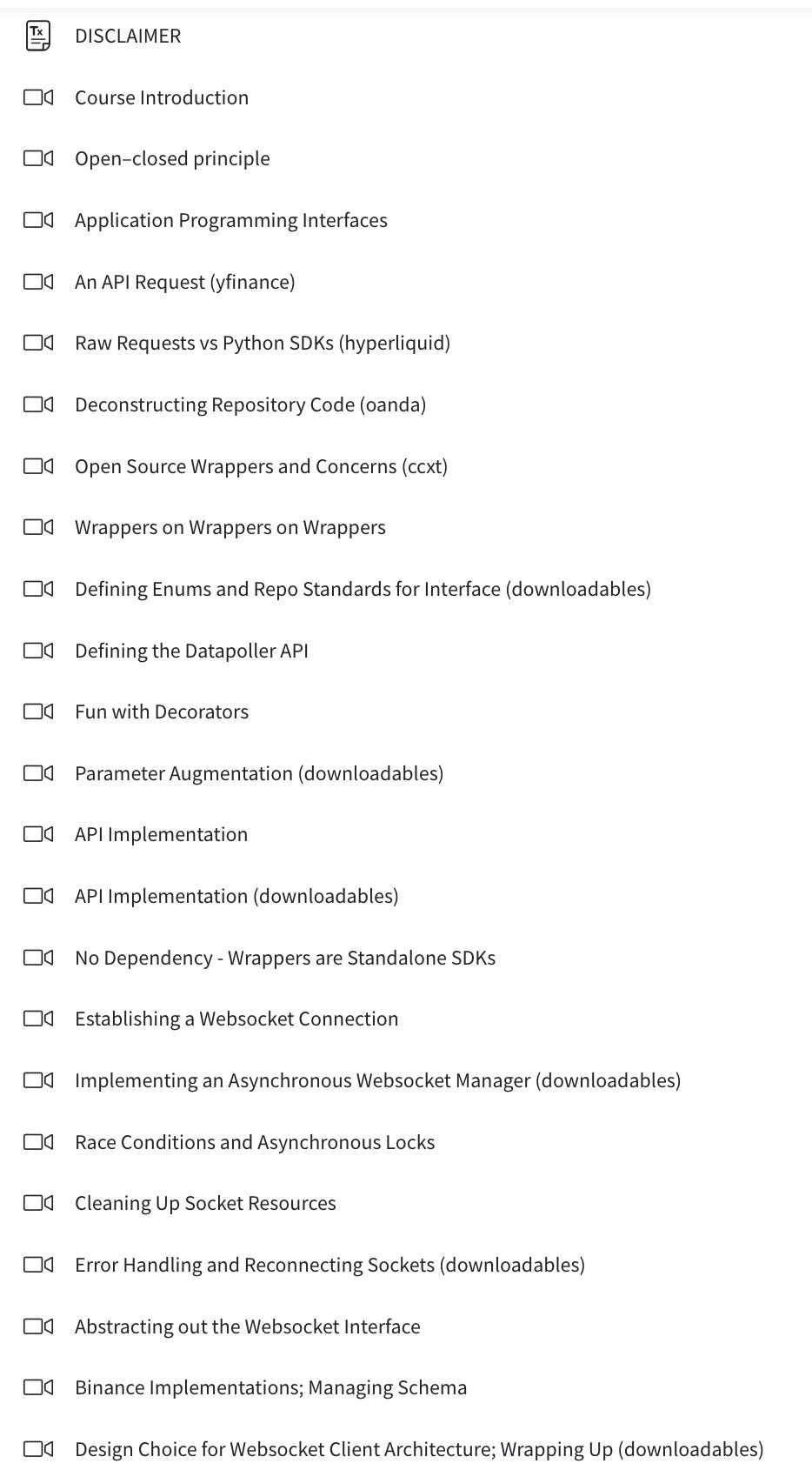

here are the lecture outlines:

in terms of the code - it is a reduced, but in-depth tour and explanation of the design choices in quantpylib.datapoller.

Over the last three months - we have addressed many different areas of quant dev - I just wanted to use this post to sum up and give a recap - often, giving too much information is same as none at all - you get overwhelmed and ignore the whole thing.

Here are the critical things you need to know

we have a logging stack in quantpylib, and you should be able to create dashboards to track system logs - it is a whole series

we have a post on how to trade your strategy live - using quantpylib - a very simple template to encode tons of strategies and trade it on your timeframes

this of course was facilitated by the exchange gateway

If you want some ideas on trading - the classic one that most go to is momentum. Here is the case study, again, using quantpylib:

This - we studied using our new module for regression - which also uses the same interface in your formulaic parser:

Which was made possible by our crypto extensions to the original alpha class:

Alot, and I mean alot of things have been added over the last few months - and I hope that a great handful of you find these useful! Very thankful all of you who have also helped in making those features come to live.

My sense is that some of the information is quite scattered, so I will consider consolidating them in the market notes, which we have not touched in awhile:

or…we could just keep programming and add on new libraries…decisions decisions.

More lecture series are coming too. Let me know if you have any feedback for the substack/thinkific through discord/twitter dms.

~cheers