To the acute of readers, we did not have a blog issue last week. It was a block-week of leave for me, and I gained an age! It’s now my fourth year of writing, with 11.5k readers, and more than 200 lifetime subscriptions (that’s pretty insane, thank you!) across research and lecture platforms.

I think I’ve done a discount this big about twice since our inception, but I guess this is a good time as any.

DISCOUNT (eligible for 1 week)

I’ve made a 1000 haircut off the quant lecture site (lectures on quant dev, infras for trading, research, carry and arbitrage): https://lectures.hangukquant.com/courses/lifetime

800 haircut off the research blog (this website, quant notes, quantpylib-repo, quantcplib-repo):

Review

I thought it’s a good time to look back and review our progress. Every once in awhile, I get a heartwarming, lovely message about my work (i really appreciate them!) Lest I be deluded, I am no saint - the biggest benefactor of the past 4 years…is me. Thank you for supporting me.

The work is technical, the content gritty, and there is nothing poseur about serious quantitative work. I really appreciate if you share me with your colleagues, friends — word of mouth is my medium. I strive to be a modicum of signal in a cesspool of attention-seeking narratives - I hope I never let you down!

Let’s look at some highlights of the year over our shoulder -

we made significant progress in quantpylib integrations, allowing traders to access exchanges such as Binance, Bybit, Paradex, Hyperliquid and Woox using native functionality, integrated with OMS etc…

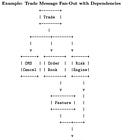

We added significant code to demonstrate market making features and demonstrated ability to integrate both mid-frequency trading strategies live and in research environments. Our funding arbitrage lectures demonstrate these in the systematic implementation of cross-exchange arbitrage strategies that harvest funding premiums and trade price dislocations.

We added integrations for betting markets, together with arbitrage strategies we can employ:

Of the many, we link a number of important technical articles discussing quantitative development/research skills, including cython programming, statistical finance methods and low-latency cpp implementation.

We will resume posts this week on state-of-the-art low latency frameworks for logging in cpp this week.